+1 888 123 4567

OCTAVIA ROBINSON

A CASHLESS SOCIETY: WHAT will buying look like in the future?

The number of British people who pay in cash is decreasing, down from 63% to 34% in the past decade. A straight-line projection based on this statistic would result in Britain becoming a fully cashless society by 2026. (Good House Keeping, 2020)

Contents

1. The Utopic Ideal of a Cashless Society

Biometrics

Cash

Environment

new technology

2. The Dystopic Reality of a Cashless Society

Online Safety

Society

Spending Habits

3. The Future of Buying

Biometrics can make your phone-based payment options the most secure way of buying. More secure than your wallet or purse. There will be no need for passwords on credit/debit cards and no risk of contactless cards being stolen. Wallets will no longer be needed, the material from them can be recycled and reused.

Biometrics can include retinal scans, facial recognition (most commonly used for iPhones), voice and fingerprint. This would make it almost impossible for people to steal your method of payment, the next 20 years calls for a much safer society.

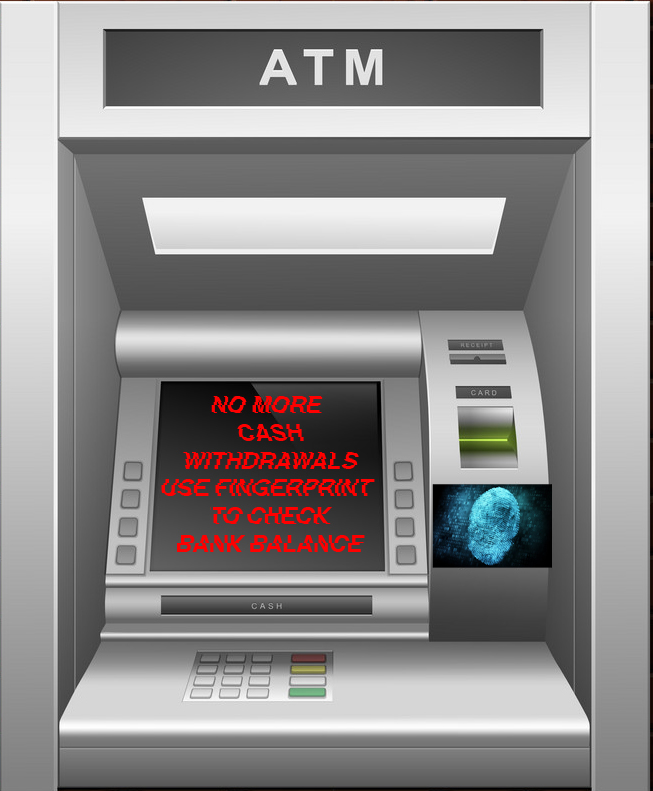

ATM usage is declining about 6-10% a year - soon this usage will come to a complete halt. ATM's will be used to help people check their online bank balance using fingerprint recognition.

(The Guardian, 2019)

No cash also means for easier currency exchange when travelling – in 10 years there will be no more need to buy everything in cash whilst you are on holiday.

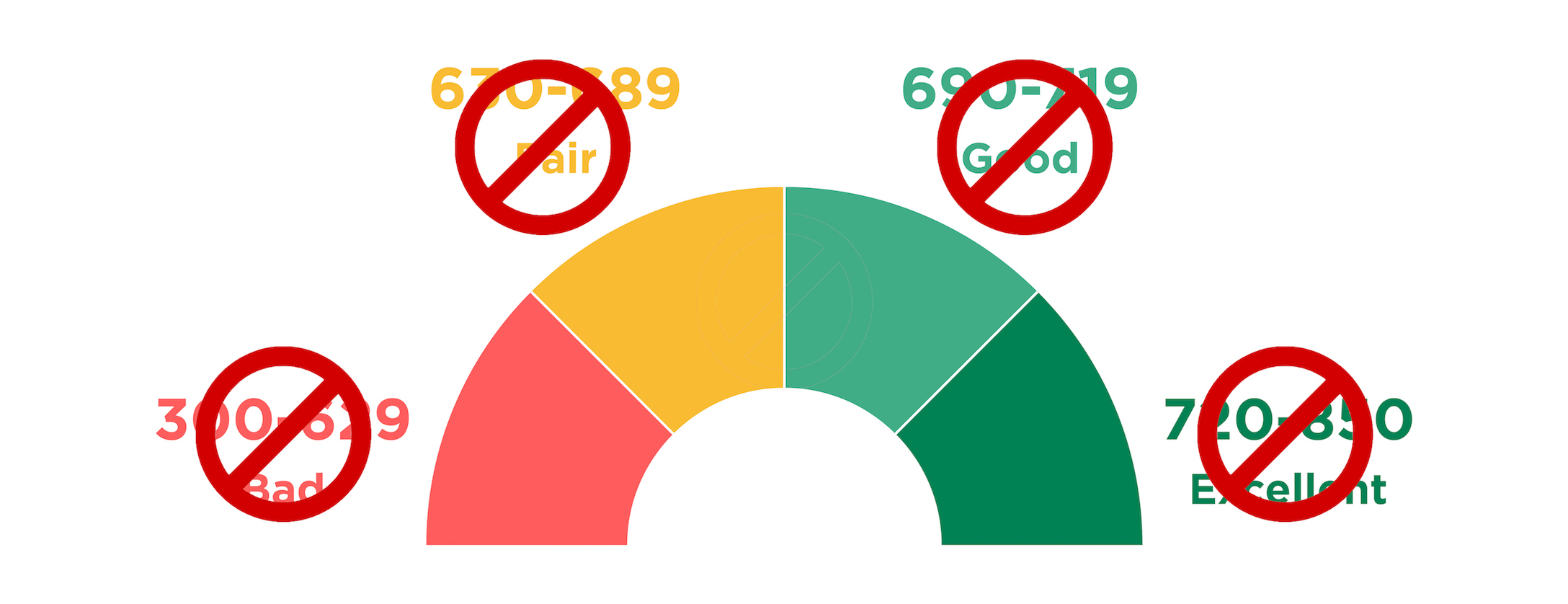

Cash will not help in improving your credit score. Your credit rating is essential for qualifying for loans and mortgages. You'll often end up paying more if you only pay in cash as you can’t find discounts online.

No more resources would be wasted on money production. Less cash in circulation also means fewer security vans emitting fumes. This would result in less pollution of cities, therefore healthier lives.

A cashless society would result in banks having a different purpose. There would be no need for secure rooms which store money. Banks could be turned into new concept spaces for fashion stores. As bank buildings are often full of character, it would be a waste of impressive architecture to knock them down - this would also be a waste of resources. By reusing them for fashion stores, tourism will be on the rise and cities will be able to make more money from it.

Britain’s cash infrastructure costs around £5 billion a year to run - and its consumers who are bearing the weight by paying taxes.

(The Guardian, 2019)

A new era of buying online calls for new technology. VR technology is being constantly developed to create an amazing user experience. It allows users to see the world from a different dimension, which will be especially useful when it comes to shopping. (GIF - GIFY)

In the future buying solely online will be a normality. Retailers are beginning to make it easier for us to buy, using VR and AI technology.

Norwegian retailer Carlings launched a digital collection last year, the fashion – futuristic streetwear, bought online and e-fitted to users’ photos – was created to counter the ‘wear once, take a selfie, chuck it away’ philosophy of today’s frantic online influencer. “We’ve opened up a world of taking chances with styling, without leaving a negative footprint on the world,” Morten Grubak of Virtue Nordic, told iD’s Jake Hall, at the time.

(BBC Designed, 2019)

The rush to a cashless society could lead to a large percentage of the population becoming financially excluded and at risk of financial exploitation. The gap between the wealthy and the poor could become even larger.

People may find it difficult to adjust to the new way of buying, particularly elderly members of society. They are often not confident in using online banking or digital methods of payment. It would be difficult to provide support to all elderly people and would require a lot of resources.

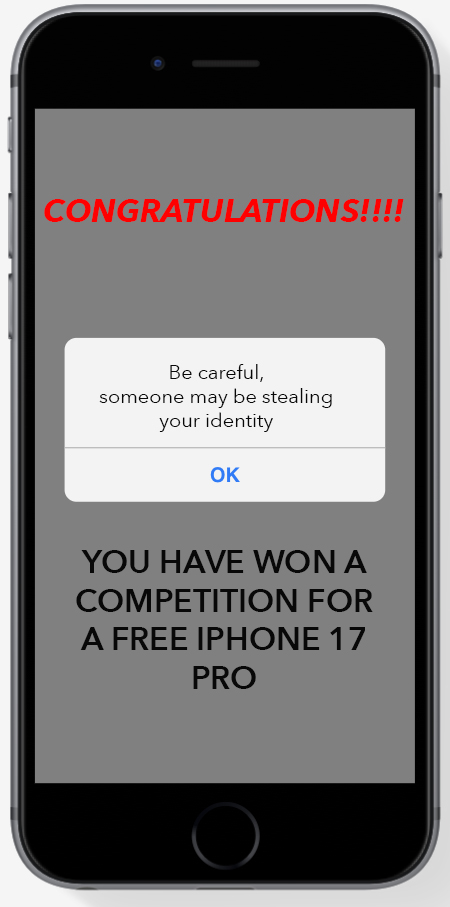

Digital transactions are very easily tracked and recorded, which raises questions about data security.

The risk of other crimes such as identity theft, account takeovers, and fraudulent transactions will also increase when digital payments become the only option.

2.3 million people aged 70 or above don't have an internet connection at home. Cash is still an economic necessity for 20.5 million people across the country, the speed at which digital finance is advancing – along with the rush of the coronavirus pandemic, runs the risk of many people being left behind.

(Prosser Knowles, 2020)

There will be no money for homeless people to buy essential food & blankets. The homeless would rely on the public to buy them essentials – this should be a job of the government. This would lead to more crime & stealing from shops as people without bank accounts will have no way of buying anything.

Consumers have already been slow to move to mobile payment and biometric ID technology. Retailers must balance the individual consumer's need for privacy and security with willingness to embrace new technologies.

Approximately 1.2 million people living in the UK are unbanked. (The Guardian, 2019)

Domestic abuse survivors often hide away emergency cash – this is for their own safety and wellbeing.

It will be vital that the government ensures everyone has a bank account, so the safety of vulnerable members of society are prioritised.

The High-street is becoming increasingly threatened with a new surge of online shopping. With the removal of the High-street there would be less opportunities for socialising and exercise.

A proportion of small businesses will be affected if they are cash only. It is more expensive for smaller businesses to introduce card payments. The next 10/20 years calls for easier payment methods which are also cheap and easy to install.

Clicking, swiping and tapping leads to people becoming much less aware of their daily outgoings. It can increase compulsive spending behaviours.

A lack of physical cash may make it harder for some people to budget. In the future there will be no way to separate a specific amount of money to spend.

THe future of buying

What will it look like?

Paying with a wave may become available. This is already happening in South Korea where biometric technology scans the vein patterns in shopper's hands. Shoppers will no longer have to worry about forgetting their wallet or cash.

Payment could potentially become invisible. Stores will be kitted out with sensors so they can see exactly what you are buying. The Amazon Go store in Seattle already has this technology. It is likely that this will happen to most stores within the next 20 years.

Retail spaces will be used as showrooms instead of shops. This means consumers will be able to try before they buy, creating a more emotive in-store experience. This will make shopping experiences more worthwhile and special.

Some brands are already trialing GPS-linked alerts. This would allow them to seek out potential customers nearby to lure them into the store.

VR immersive experiences will become more prominent in stores within the next 10 years. These experiences will allow you to see how products are made.

AR glasses will allow consumers to only see products which fit their specific preferences. Whether that is foods for their vegetarian diet, specific skin type or the type of books they like to read.

There are plans to create a shopping 'Micro-city' in London by 2028. It will include wellness centres, hanging sensory gardens, allotments and reading rooms. It has been designed to create a more emotive experience for shoppers.

Retail is soon to become ultra specialised. With millennials driving the trend for specialist products, it is likely that these stores will come about in the next 10 years. In the future we may be seeing stores dedicated to fake plants, avocados or even selfies.